The marine products industry, especially through deep processing and comprehensive utilization, not only solves the dilemma of perishability and seasonal abundance but also maximizes the utilization of these products, thereby significantly enhancing their value.

Between 2015-2021, China’s aquatic product processing capacity exceeds 28 million tons annually. However, there’s a growing wave to ride – the increasing demand and fluctuating supply of fish oil products in China.

China’s main fish oil imports in 2021 were from Peru, Vietnam, and Chile, totaling about 43,309.3 tons, 19,988.5 tons, and 9,503.7 tons, respectively. Despite producing 254,600 tons of fish oil in 2018, domestic production is completely insufficient to meet processing needs. This gap, coupled with rising fish oil prices and increasing demand for health products as living standards improve, creates lucrative opportunities for exporters.

Navigating this market requires more than just a compass; it demands an in-depth understanding of the trends and legal intricacies. As a seasoned navigator in this industry, let me guide you through the essentials of exporting to China, ensuring your cargo reaches safe harbors.

What’s the Current State of China’s Fish Oil Market?

China’s fish oil industry primarily relies on imports of crude fish oil and fish meal. According to the General Administration of Customs of China, in 2021, China imported 86,100 tons of fish oil products, approximately 33.5% increase year-on-year. Meanwhile, exports decreased by 16.91% to 22,600 tons. Given this trend and the escalating fish oil prices, it’s pivotal for exporters to understand the nuanced process of exporting marine fish oil and fish meal to China.

The fish oil market in China has seen a roller coaster of changes, with prices peaking in 2020 at approximately 67,712 yuan per ton for crude fish oil. The post-pandemic era saw a slight price drop, but prices keeps surging after Pandemic period. The rise in health supplement demand is expected to keep pushing these prices upwards.

Why is China Heavily Reliant on Fish Oil Imports?

The production of fish oil in China is on the rise, with over 150 companies involved last year, spanning various industries such as food additive, nutrient addition&supply, fertilizer, agriculture, and pharmaceuticals, etc.

The processing technology of Chinese fish oil refinery plants have reached the international standard, the product quality are highly recognized and acknowledged by GOED members and other international organization.

Currently, China’s fish oil market is in a state of demand outstripping supply, necessitating imports to satisfy the continuously growing domestic demand. Market demand is shifting towards concentrated fish oils with higher EPA and DHA content, hence increased demand for EPA and DHA rich fish oil origins. Growth in nutritional food and pet food is leading to another acceleration in the growth of the crude fish oil market.

With technological advancements, improving policy support, and deepening internationalization of the industry, the development prospects are strong. Pharmaceutical approvals for omega-3 APIs(active pharmaceutical ingredients) are underway in China, which could have a huge impact on the market. Growth in this segment will lead to a significant increase in demand for crude fish oil. Click here for more details about the process technology.

Despite these advancements, China’s fish oil industry, while having clear advantages such as large production capacity, high proportion, comprehensive technical resources, diverse product forms, and stable product quality, still relies heavily on imports.

This is evident in the import value of fish oil reaching $320 million in 2021, a 21.7% increase year-on-year. The global production of fish oil is concentrated in areas like Peru, Newfoundland, Hokkaido, and the North Sea, with Peru being the largest exporter to China, accounting for 51.2% of China’s total fish oil imports.

China’s reliance on imports is underscored by its fluctuating processing volumes. In 2019, the processing total dipped to a low of 49,000 tons but rebounded to 67,800 tons by 2021, showing a 27.44% increase. This ebb and flow create a unique opportunity for agile exporters to fill the void.

What Legal Frameworks Govern Fish Oil Export to China?

Navigating the legal seas can be daunting, but it’s crucial.

The export of fish oil to China is governed by a comprehensive legal and regulatory framework, which ensures that only products meeting stringent health and quarantine standards are permitted entry.

This framework is a result of collaboration between the General Administration of Customs of the People’s Republic of China and the local Ministry of Fisheries of origin Countries, Water Resources, and National Assembly Affairs, specifically addressing the import requirements for fish meal, fish oil, and other aquatic animal proteins and fats from original Countries.

Key Legal and Regulatory Documents

- Primary Laws and Regulations:

- The Biosecurity Law of the People’s Republic of China

- The Entry and Exit Animal and Plant Quarantine Law of the People’s Republic of China and its implementing regulations

- The Import and Export Commodity Inspection Law of the People’s Republic of China and its implementing regulations

- Regulations on Feed and Feed Additives Management

- Specific Management Methods:

- The Management Methods for the Inspection and Quarantine of Imported and Exported Feed and Feed Additives

- Bilateral Agreement:

- The Protocol between the General Administration of Customs of the People’s Republic of China and the Ministry of Fisheries, Water Resources of the original Countries on the Quarantine and Health Requirements for original Fish Meal, Fish Oil, and Other Aquatic Animal Proteins and Fats Exported to China

These legal documents and agreements form the basis for inspection and quarantine procedures, ensuring that all imported fish oil products from the original Countries meet the required health and safety standards, thereby maintaining the integrity and safety of China’s aquatic product market.

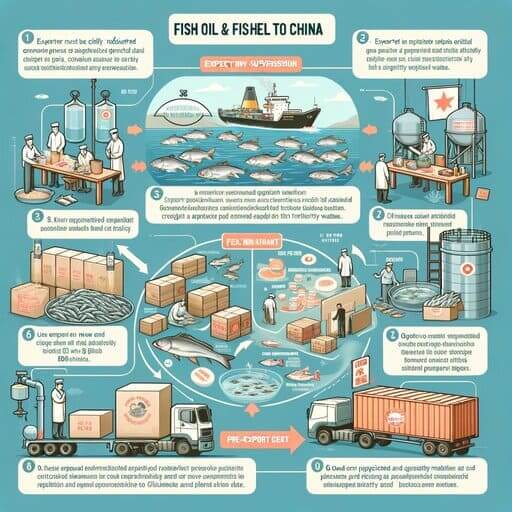

What Specific Requirements Must Exporters Meet?

Exporters of fish meal, fish oil, and other aquatic animal proteins and fats to the People’s Republic of China must adhere to stringent criteria to ensure compliance with Chinese regulations. These requirements are detailed and precise, reflecting China’s commitment to maintaining the highest standards of quality and safety in its imports.

Production Enterprise Requirements

- Official Registration and Supervision:

- The exporting enterprise must be officially registered and approved in the country of origin and operate the processing line under effective supervision. Products must be permissible for sale in the local market.

- Quality Management System:

- Establish and implement a quality management system based on Hazard Analysis and Critical Control Point (HACCP) principles. This includes developing and effectively executing product recall and traceability systems.

- Approval and Recommendation Process:

- The enterprise must be recommended by the Ministry of Fisheries, Water Resources, and National Assembly Affairs of the country of origin (referred to as the “original Country side”) to the General Administration of Customs of the People’s Republic of China (referred to as the “Chinese side”). Registration with the Chinese side is a prerequisite for exporting to China.

Raw Material and Product Requirements

- Source of Raw Materials:

- Raw materials must be derived from aquatic animals caught in the territorial waters or high seas of the country of origin, or as by-products from the processing of these animals for human consumption.

- Prohibition on Certain Materials:

- Use of aquatic animals culled due to disease control or those with unknown causes of death is prohibited.

- No use of animal-origin materials of unknown source or prohibited substances is allowed.

- Health and Safety Standards:

- Products must not contain any substances harmful to animal health.

- Compliance with the Chinese national standard “Feed Hygiene Standards” (GB13078) is mandatory.

- If the product falls within the scope of registration with the Ministry of Agriculture and Rural Affairs of China, it must also meet these registration requirements.

Production Process Requirements

- Heat Treatment:

- During the production and processing phase, products must undergo heat treatment with a central temperature of no less than 85°C for a minimum duration of 15 minutes.

- Pre-Export Testing:

- Official testing by the country of origin must be conducted on samples prior to export to China. This includes testing for Salmonella (n=5, c=0, m=0, M=0) and E. coli (n=5, c=2, m=10, M=300), where ‘n’ is the number of samples tested, ‘m’ is the threshold bacterial count for acceptable results, ‘M’ is the maximum bacterial count for rejection, and ‘c’ is the number of samples where bacterial count is between ‘m’ and ‘M’.

- PCR Testing:

- PCR testing for ruminant-origin components must be conducted by an officially recognized laboratory in the country of origin, with results being negative.

Packaging, Labeling, and Storage and Transportation Requirements

- Packaging Standards:

- Each batch of products destined for China must be packaged in new, clean packaging materials.

- Labeling Requirements:

- Packaging must include Chinese labels compliant with the “Feed Label” national standard of China (GB 10648). This includes the name and registration number of the production enterprise and warnings such as “Not for Human Consumption” or “For Feed Use Only”.

- Prevention of Contamination:

- Effective measures must be taken during production, storage, and transportation to prevent contamination.

Pre-Export Inspection and Certificate Requirements

- Official Inspection and Quarantine:

- The country of origin is responsible for inspecting and quarantining the products bound for China, issuing a health certificate to prove compliance with the agreed-upon requirements.

- Accompanying Health Certificate:

- Each batch of products exported to China must be accompanied by an original official health certificate.

Import Inspection and Quarantine Requirements for Fish Oil and Fish Meal in China

When importing fish meal, fish oil, and other aquatic animal proteins and fats into China, there are stringent inspection and quarantine requirements set by Chinese Customs. These requirements are designed to ensure that all imported products meet the highest standards of safety and quality, as per Chinese laws and regulations.

Quarantine Approval Process

- Quarantine Permit:

- Importers must apply for an “Entry Animal and Plant Quarantine Permit” prior to signing the trade contract, except for products that are exempt from quarantine approval.

Verification of Documentation

- Verification of Quarantine Permit:

- Ensure the presence of a valid “Entry Animal and Plant Quarantine Permit.”

- Verification of Enterprise Registration:

- Confirm that the products originate from a registered and approved foreign production enterprise.

- Verification of Health Certificate:

- Check the authenticity and validity of the health certificate accompanying the goods.

Inspection of Goods

- Customs Inspection:

- Chinese Customs will inspect and quarantine the imported fish meal, fish oil, and other aquatic animal proteins and fats according to the relevant laws, administrative regulations, rules, and requirements of this announcement. Only products that pass inspection and quarantine will be allowed entry.

Handling of Non-Compliant Situations

- Lack of Valid Health Certificate:

- Products without a valid health certificate will be returned or destroyed.

- Products from Unregistered Overseas Production Enterprises:

- Products originating from non-registered foreign production enterprises will be returned or destroyed.

- Detection of Unapproved Animal-Origin Components:

- Products containing unapproved animal-origin components will be returned or destroyed.

- Discovery of Prohibited Items:

- In the event of finding soil, animal carcasses, animal excrement, or other prohibited items, the products will be returned or destroyed in accordance with relevant laws and regulations.

- Safety and Hygiene Standards Non-Compliance:

- Products that fail to meet China’s feed hygiene standards will undergo processes to remove harm, be returned, or be destroyed.

- Damaged Packaging:

- The responsibility for repackaging or proper disposal falls on the owner or their agent if the packaging is found to be damaged or broken. If the packaging poses a risk of spreading animal or plant diseases, quarantine treatment will be applied to the contaminated site, items, or equipment.

These rigorous inspection and quarantine procedures reflect China’s commitment to maintaining high standards of public health and safety in the import of fish oil and fish meal products. Compliance with these requirements is essential for any enterprise looking to enter the Chinese market in this sector.

Conclusion

In the ever-evolving world of marine product exports, one truth remains constant: the sea of opportunity in China’s market is vast. With a processing capacity of over 28 million tons annually and a noticeable gap between domestic production and demand, the opportunity for fish oil and fish meal exporters is immense.

Understanding the intricate process of exporting fish oil and fish meal to China is crucial for tapping into this growing market. With China’s increasing reliance on imports and the rising demand for health products, there’s a significant opportunity for exporters who can navigate these regulatory waters.

For further technical and commercial discussion about the exporting of your fish oil and fish meal products to China, please fill below form and don’t hestiate to reach out to us directly.

reference resources:

https://www.fda.gov/food/exporting-food-products-united-states/food-export-library

https://www.transcustoms.com/food/food_guide.asp?id=36&code=02.01.02&ename=Animal fats (including lard, tallow, fish oil, and other animal fats)